AI and the Retail Marketer’s Future

How AI transforms strategy and processes, driving the adoption of Positionless Marketing

Exclusive Forrester Report on AI in Marketing

After what was the busiest online shopping period in the history of humankind (2020 Black Friday/Cyber Monday + Christmas), we were all expecting the RETURNAGEDDON to follow suit in late 2020/early 2021.

Yet somehow, these fears did not materialize. Contrary to all predictions, judging by Optimove's vast research, the number of returns made after the 2020 shopping season was not only much lower than expected – it was in some cases lower than that of a year before - in spite of the historic surge in online shopping since the start of COVID-19.

Is this a good or bad thing, though?

Well, on the one hand, you do not want to be dealing too much with the logistics of too many returns. Not to mention the lost revenue.

On the other hand, we already know that customers who make returns have higher lifetime value, generate higher ROI, and tend to be more loyal. The future value of these customers is higher on average, too.

So, wait, does that mean you should AIM for product returns?

Not so quickly.

Even though brands can be smart and efficient about product returns in a way that turns the returners into better customers long-term, intentionally creating more product returns shouldn't be your end goal. Instead, make it: Personalization. You'll see why.

Optimove calculates the return percentage by the number of returned or partially returned orders divided by the number of purchases per month.

Interestingly, we see that returns as a percentage of total purchases have decreased this past post-shopping season compared to the one before. The return percentage in late 2019 was 12% compared to 9% in November 2020.

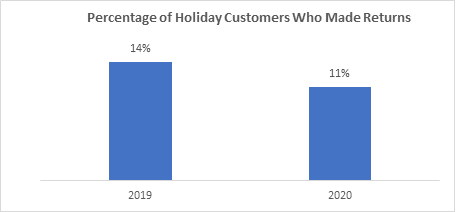

Additionally, we see a drop in the percentage of BF/CM+Xmas customers who made a return for the retail brands we analyzed, too: 14% of 2019 BF/CM+Xmas customers made a return vs 11% in 2020.

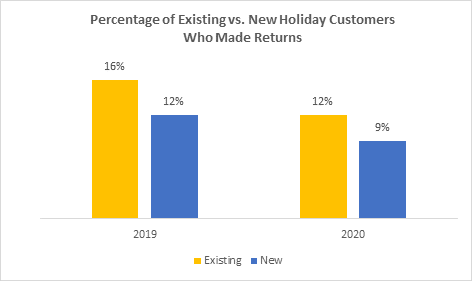

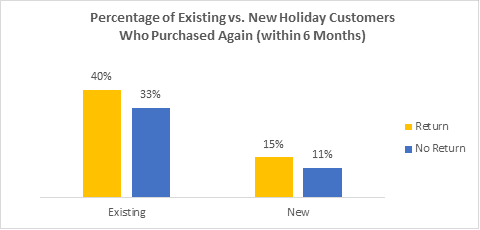

Not surprisingly, though, for almost every brand analyzed, we again saw that a greater percentage of returns came from existing customers vs new ones:

Additionally, "Shopping Season" customers who make returns are more likely to make another purchase within the next six months. That we know, and that does not seem to change, either.

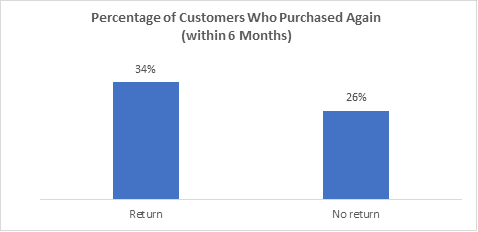

On average, 34% of "Shopping Season" customers who made returns made a purchase within the next six months vs. 26% of customers who did not make a return.

Finally, for nearly every brand analyzed, we see that new customers who made a return have a higher percentage of purchase within the next six months than those who did not return (43% on average).

And there's a similar trend happening for the future value of customers. New customers who made a return had higher future value than new customers who did not make a return (a significant 28% higher on average).

You might be asking yourself now, "How come there were fewer returns when there was an expected RETURNAGEDDON, and everyone was buying online?"

We asked that question, too. And a few experts we tossed that ball to returned it with a note that said: personalization.

This is a two-sided thing. First, we all got a bit better at shopping online over the busiest eCommerce year ever, as brick-and-mortar stores shut down and shelter in place orders surged amid the pandemic. As the "new normal" became just, well, normal.

See, customers are always getting savvier. Combine that with a year of economic downturn (on top of the pandemic) and more time with their computers and phones, and you might get consumers who are more accustomed to buying online, and who did more research than ever before.

Secondly, the hyper-accelerated digital transformation movement that thousands of brands joined these past 12 months meant that basically, every relevant business offers a much better online shopping experience now compared to a year ago.

Part of that means that the shopping experience is more personalized than ever before.

Since our research was based on Optimove clients' data - and these brands are all smart about personalization, of course - this might be the case: Optimove clients offer a better, more personalized shopping experience than your average brand - which perhaps helps to explain the low return rates.

Making it easier for customers to buy the right thing for them could also result in lower return rates. It's only logical.

Bottom line, gaining a deep understanding of who each customer is, and delivering them the right message at the right time, through the right channel – might have helped Optimove clients to avoid more returns this year.

Still, it's nice to remember that with a hyper-personalized CRM system at their helm, those same brands are also generating growth from customers who do return.

We call it a win-win.

Exclusive Forrester Report on AI in Marketing

In this proprietary Forrester report, learn how global marketers use AI and Positionless Marketing to streamline workflows and increase relevance.

Writers in the Optimove Team include marketing, R&D, product, data science, customer success, and technology experts who were instrumental in the creation of Positionless Marketing, a movement enabling marketers to do anything, and be everything.

Optimove’s leaders’ diverse expertise and real-world experience provide expert commentary and insight into proven and leading-edge marketing practices and trends.